Disclaimer: This post contains affiliate links.

So I have gone back & forth between paper budget tracking and Quicken Deluxe and I have come to realize that I am just a paper & pen kind of gal. I have finally found a PRETTY solution that works the way I think.

If you are interested in making your own, I used:

- Quicken Deluxe 2016 Personal Finance & Budgeting Software

- Quicken Deluxe 2016 Personal Finance & Budgeting Software

- 5/8″ Proclick Spines

- 28lb Printer paper

- Clean Mama Everyday Budget & Bill Pay Kit

- Pilot FriXion Clicker Retractable Erasable Gel Pens

- Set of 8-Tabs — any set will do; I used some I had on hand

Now, on to the tour :).

Essentials

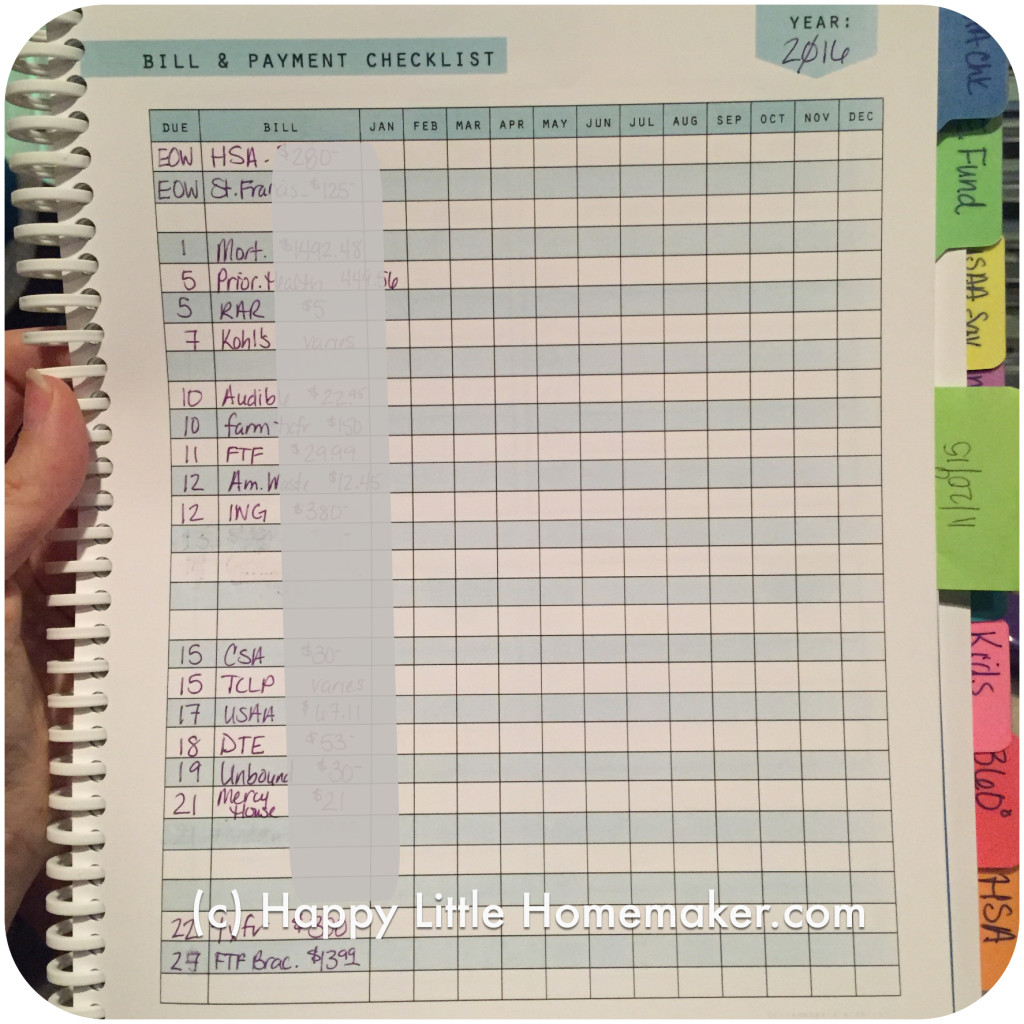

Behind the lovely cover, I keep 3 pages. The first is a list of known expenses by date. I use this page as my “budget” each period, so I know how much I have for discretionary spending. This is the Bill & Payment Checklist page from the Clean Mama Kit on Etsy.

Behind that is our monthly (theoretical) zero-based budget. This an excel template I downloaded off of Office.com years ago.

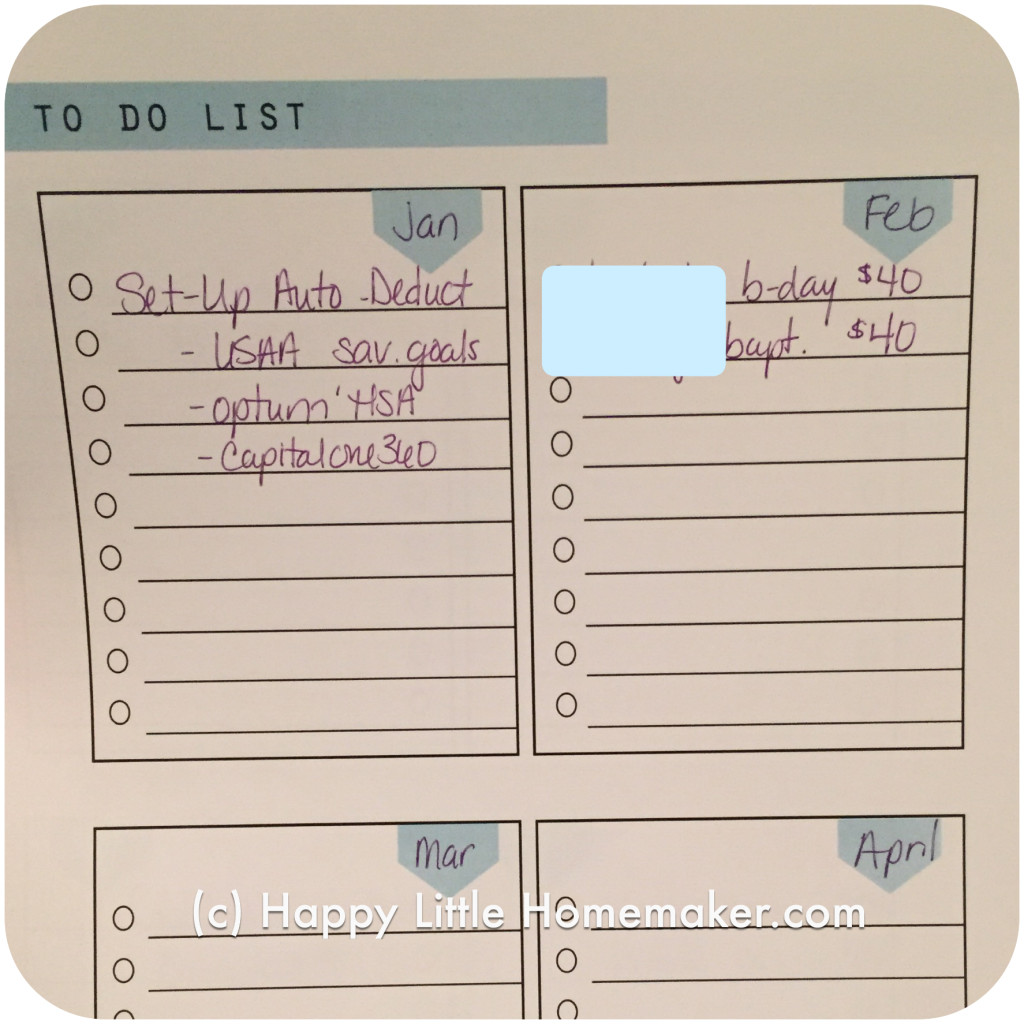

I also have a set of tasks that need to be done in each month. I found that because I have things set up so I didn’t have to think about them, I was losing track of things like life insurance policy payments and such that I only have to do infrequently. This form is a freebie from Clean Mama.

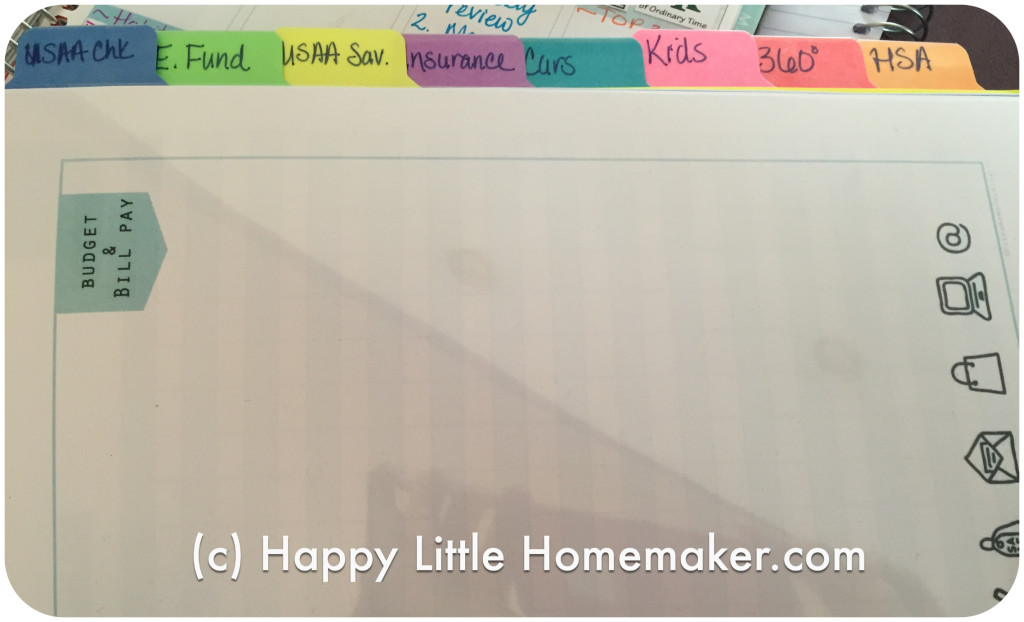

Bank Account Registers

I have several tabs containing my bank account register pages for our various checking and savings accounts. This includes our primary checking and savings accounts, but also things like our kids savings accounts, our homeschool/Christmas account, and our HSA. Retirement and investment accounts could be tracked like this also.

One thing I do to track my spending is this: when I enter our paychecks, I subtract all the expenses that need to be paid from that check so I know what I have left for discretionary expenses.

I know what our budget is, but when we operate on cash only, I still need to know if I can buy the nail polish rack this payday or if I should wait until next payday. Ahem!

Savings Goals & Extras

We also have several sections related to long-term savings as well as our savings goals for insurances and other household. I track all these items using the checkbook register pages.

We have a separate page for each insurance type policy “savings account” as well as things like car repairs, registration, and our “buy a cow fund.”

Practically, I have one savings account that is only for savings goals. Within that I have pretend accounts — so I have a register page for car repairs, our cow fund, and the life insurance. Monthly, I “contribute” to each as a transfer into the savings account. If I add up the car repair balance, the cow fund balance and the life insurance balance, it SHOULD equal the savings account balance. Clear as mud?

At the very end, I keep usernames & hints for financial accounts in the Password Log. These are VERY cryptic and don’t even necessarily list the website but an abbreviation for it, plus u/p hints.

Paper Vs. Quicken

Why do I use paper? It’s just simpler. With Quicken, I felt compelled to categorize things and reconciling bank accounts AND categorizing transactions took forever. Since my kids are little, it was hard to get on the computer for enough time to take care of things properly and the Quicken app on my iPhone was a pain to use.

With pen & paper, I can spend 5 minutes a day, plus a few more on weekends to keep on top of things. By taking upcoming bills out of the paycheck as soon as it is deposited, I know exactly how much I have to spend at any given time. Plus, it’s kind of freeing not to track every little expense. I mean, have you ever gone to Target and bought only clothes? Or only household items? Or just food? Yeah, me neither.

There are limitations. Math errors. Missing items. Double entry. But, I can take it with me for easy updating on long vacations or business trips because it’s the size of a notebook. Alternately, you could use a binder, but I find having it bound with a ProClick makes it infinitely easier to use because it can fold on itself like a notebook AND I can add/move pages.

Overall, though, keeping paper records works for me!

How do you manage your finances?